Overview

New light-duty vehicles imported into New Zealand are subject to annual greenhouse gas emission standards measured in grams of CO2 emissions per kilometer. In 2023, light passenger vehicles must meet a standard of 145g CO2e/km, while light commercial vehicles must not emit more than 218g CO2e/km. These standards increase stringency to 63.3g CO2e/km and 87.2g CO2e/km in 2027 for light-duty passenger and light commercial vehicles, respectively.

Greenhouse gas (CO2) emissions standard

Current Standard

Clean Vehicle Standard and Clean Vehicle Discount Scheme (2022)

Imported light-duty passenger and commercial vehicles with a tare weight ≤ 3,500 kg

History

New regulations for on-road vehicles in New Zealand are passed as amendments to two pieces of legislation administered by the nation’s Ministry of Transportation: The Land Transport Act 1998 and the Land Transport Management Act 2003. All New Zealand’s light-duty vehicles (LDVs) are imported. Accordingly, most LDVs sold have their emissions tested using cycles other than New Zealand’s approved 3P-WLTP (Three-Phase Worldwide Harmonized Light-Duty Vehicles Test Procedure) cycle. New Zealand requires importers to convert these results to the 3P-WLTP cycle before their vehicles can be certified.

New Zealand passed its first-ever greenhouse gas emissions standards for light-duty vehicles in 2022 with the Clean Vehicle standard found in Part 13 of the Clean Vehicles Act Amendment. Starting in 2023, the Act sets annual CO2 emissions targets for vehicle importers. The Clean Vehicles Act also expanded on a 2021 program that provided rebates for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). “The Clean Car Discount” now encompasses all new and used light vehicles and introduces an entire bonus-malus scheme designed to increase consumer demand for zero- and low-emission vehicles using taxes and rebates. The program imposes taxes on the purchase of high CO2 emitting vehicles and uses the revenue from those taxes to give rebates to purchasers of low-emitting vehicles. Vehicles deemed to have neither very low nor high emissions are not subject to rebates nor charges.

Technical Standards

Vehicle and importer definitions: Part 13 of the Land Transport (Clean Vehicles) Amendment Act establishes two classes of light motor vehicles: “Type A” vehicles are designed to carry passengers, have fewer than nine seats, and typically consist of cars and SUVs. “Type B” vehicles, typically vans and utility vehicles (utes), are designed to carry passengers or goods and have more than nine seats. The Clean Vehicles Act also distinguishes between two different types of vehicle importers. Category 1 importers are in the business of importing light vehicles on a commercial scale, while Category 2 importers typically import one or a few vehicles for personal reasons. The Ministry of Transportation designates importers either Category 1 or 2 on a case-by-case basis.

Clean Vehicle Standard: The Clean Vehicles Amendment Act sets weight-based fleet-wide CO2 emissions standards for Category 1 importers (in grams of carbon dioxide per kilometer) for type A and type B vehicles. The measures shown in table 1 have not been adjusted for fleet-wide average vehicle tare weight, which must be calculated by the importer using the equations below. is the weight in kilograms of the vehicle when it is empty of passengers and or cargo. A vehicle importer must calculate their fleet-wide compliance for each vehicle type separately. According to the second set of equations, category 2 importers must comply with the same standards outlined in table 1 but on a per-vehicle basis.

For fleets (Category 1 importers):

Supplier’s Type A fleet CO2 target = annual Type A fleet target + a * (M – M0)

Supplier’s Type B fleet CO2 target = annual Type B fleet target + a * (M – M0)

Where:

- a: The slope of the emissions limit line, which is derived through the correlation of vehicle tare weights and CO2

- M: The weighted average tare weight in kilograms of all light-duty vehicles of a given type imported by the supplier.

- M0: The weighted average tare weight in kilograms of all light vehicles imported (Type A or Type B depending on the target vehicle type)

For individual vehicles (Category 2 importers):

Type A CO2 target = annual Type A vehicle target + a * (V – V0)

Type B CO2 target = annual Type B vehicle target + a * (V – V0)

Where:

- a: The slope of the emissions limit line, which is derived through the correlation of vehicle tare weights and CO2 emissions of the vehicles that entered New Zealand in the past year.

- V: The tare weight in kilograms of the vehicle

- V0: The weighted average tare weight in kilograms of all light vehicles imported (Type A or Type B depending on the target vehicle type).

| Vehicle Type | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| Type A | 145g CO2e/km | 133.9g CO2e/km | 112.6g CO2e/km | 84.5g CO2e/km | 63.3g CO2e/km |

| Type B | 218.3g CO2e/km | 201.9g CO2e/km | 155g CO2e/km | 116.3g CO2e/km | 87.2g CO2e/km |

Testing

Part 13 of the Clean Vehicles Act specifies the three-phase variant of the Worldwide Harmonized Light Vehicles Test Procedure cycle (WLTP) as its approved test cycle for imported vehicles. New Zealand omits the cycle’s fourth, “extra high speed” phase (up to 131.3 km/h) since vehicles cannot legally achieve such speeds on NZ roads. More information about the WLTP cycle can be found on the WLTP page. As such, CO2 emissions from these vehicles must be measured in grams per kilometer. If an imported vehicle’s emissions have been calculated using a different test cycle, the Ministry of Transport may estimate emissions that would have been expected if the vehicle had been tested with WLTP and use these figures to calculate compliance.

Compliance

Light vehicle importers that exceed CO2 targets and do not have enough CO2 emissions credits in their account to offset their deficit are subject to fines. From January 1, 2023, Category 1 importers out of compliance must pay NZ$22.50 per gram of CO2 above the target multiplied by the number of used vehicles in their fleet and NZ$45/gCO2 above the target multiplied by the number of new vehicles in their fleet. From January 1, 2025, these rates increase to NZ$33.75/gCO2 per used vehicle and NZ$67.50/gCO2 per new vehicle. Category 2 importers face lower fines; NZ$18.00/gCO2 for used vehicles and NZ$36.00 g/CO2 for new vehicles in 2023, which changes to NZ$27.00/NZ$54.00 per gCO2 in 2025.

| Year | Category 1 | Category 2 | ||

|---|---|---|---|---|

| New | Used | New | Used | |

| NZ$/gCO2e | ||||

| 2023 | $22.50 | $45.00 | $18.00 | $36.00 |

| 2025 | $33.75 | $67.50 | $27.00 | $54.00 |

Under the Clean Vehicle Standard, when an importer’s fleet-wide average emissions are below the applicable fleet target, they may bank the excess reductions in the form of credits and carry them forward to the following year. Unused banked credits expire three years after they are earned. Importers with these unused credits may transfer them to other importers. Credits generated from the certification of new vehicles may not be used to meet obligations for used vehicles and vice-versa.

For obligation years 2023-2025, Category 1 light-vehicle importers can apply to defer their fleet-wide target obligations to the following year. At the end of that year, the importer must ensure that they have met or bettered their fleet-wide standard in both that year and the deferral year.

Clean Car Discount Scheme

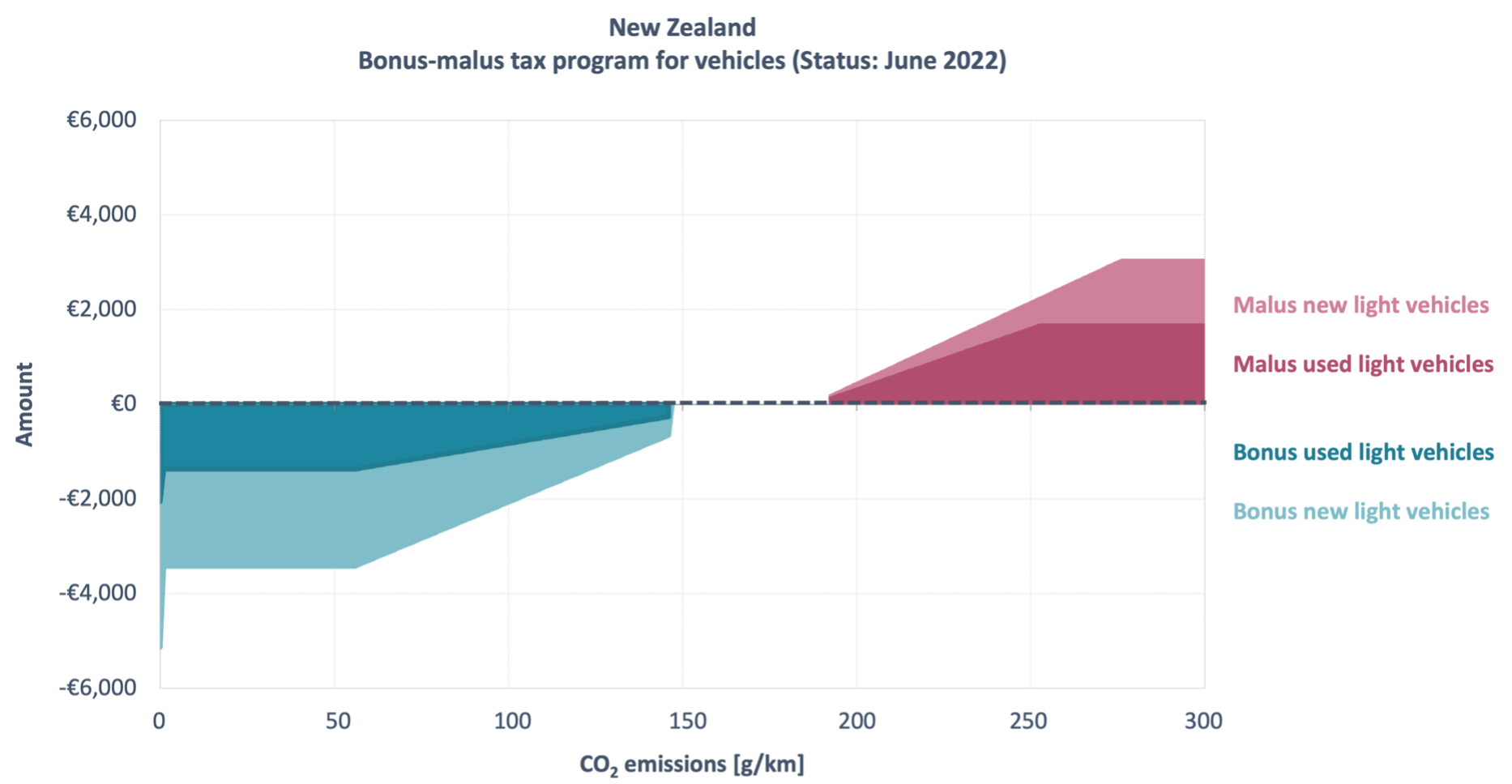

New Zealand’s bonus-malus or “feebate” program imposes taxes on the purchase of high CO2 emitting vehicles while using tax revenue to give rebates to purchasers of low-emitting vehicles. The magnitude of rebates and taxes on used vehicles are lower than those that apply to new vehicles. For new vehicles, the maximum rebate is NZ$8,625 (€5,112) for emissions of 0 g CO2/km and NZ$3,450 (€2,045) if official CO2 emissions range between 1 and 56 g/km. For new vehicles with CO2 emissions between 56 and 146 g/km, the rebate decreases linearly to a (€651). The fee for high-emitting new vehicles starts at 192 g CO2/km at NZ$345 (€204) and increases linearly to a maximum of NZ$5,175 (€3,067) for cars emitting All subsidy and rebate amounts include GST (Goods and Services Tax), a 15% tax added to the price of most goods and services in New Zealand, including imports. Price conversions are based on the average NZ$ to Euro exchange rate, which was 0.593 in July 2022. Figure 1 displays the bonus and malus curves under the program in Euros, while Table 2 shows calculations for rebate and fee magnitudes.

| Vehicle carbon emissions (g CO2 e/km) |

Used vehicles | New vehicles |

|---|---|---|

| rebates | ||

| 0 (zero emissions vehicle) | $3,000 | $7,500 |

| 1 ≤ emissions < 57 | $2,000 | $5,000 |

| 57 ≤ emissions < 146 | $3,000 – (emissions × $20 × 130/145) | $7,500 – (emissions × $50 × 130/145) |

| 146 ≤ emissions < 192 | $0 | $0 |

| fees | ||

| 192 ≤ emissions | (emissions – 186) × $37.50 Capped at $2,500 |

(emissions – 186) × $50 Capped at $4,500 |

| Note: All figures are exclusive of Goods and Services Tax (GST). Final amount of rebate paid will however include GST, except for public authorities, which cannot claim the GST. All figures shown are in NZ$ |

||

Links

Regulatory Documents

Land Transport Management Act 2002

Land Transport (Clean Vehicles) Amendment Act 2022

Additional Resources

Incentivizing Zero- and Low- Emission Vehicles: The Magic of Feebate Programs – ICCT Blog post

Clean Car Discount overview – Waka Kotahi (NZ Transport Agency)